White-collar crime

White-collar crime encompasses complex and diverse issues and it is specific according to its forms and manner of commission.

It leaves great consequences on the functioning and integrity of the economic, financial and monetary systems, business activities and goods and services markets, and represents a major threat to economic development. Organized criminal activities, through which some of the most serious crimes in this area are committed, are the most dangerous.

The motive of white-collar crime, which occurs in the context of dynamic economic relations, is to gain as much illegal proceeds as possible. It requires complex links among a large number of participants within the same or different economic processes.

The detection and proving of criminal offenses in this area (and especially their organized forms) is difficult, because perpetrators skillfully adapt to changes in all sectors of business operation in which they can find an opportunity for illegal gain.

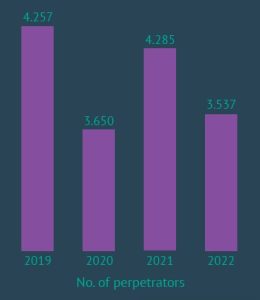

In the period between 2019 and 2022, white-collar crime accounted for nearly 7% of all crime in Serbia. On the average, about 5,000 such crimes were detected annually and about 3,700 perpetrators were reported.

Illegal proceeds of nearly RSD 91 billion were obtained and damage of nearly RSD 59 dinars was caused.

Tax crimes, money laundering and smuggling of excisable goods continue to be the offenses that cause the highest loss to the budget.

A prominent offense from the monetary aspect is counterfeiting of money, where, despite the current stagnation, there is always a risk of emergence of organized forms.

Smuggling of and Illicit Trade in Excisable Goods

The smuggling of and illicit trade in excisable goods represent a constant threat to market stability and legal business flows. In addition to direct damage caused to the budget, they also result in a decrease in legal trade, drop in prices, loss of business reputation among consumers and foreign investors, lack of competitiveness, undermining of business standards, less trust in the institutions of the system, financing of other criminal activities, etc.

Smuggling of and Illicit Trade in Cigarettes

Global and Regional Nature of the Issue

The smuggling of and illicit trade in cigarettes have been a global problem for years. The total consumption of cigarettes in the EU member states dropped in 2022, but in 2021, the consumption of illicit cigarettes in the region increased by 3.9%, i.e. by 1.3 billion cigarettes, reaching a total of 35.5 billion cigarettes. This is indicated in the annual KPMG study on illicit cigarette consumption in the EU, United Kingdom, Norway and Switzerland.

Illicit cigarette production is increasingly moving to the west of Europe, in order to approach, for example, the French and British markets where the prices are higher. The consumption of illicit cigarettes is significantly affected by an increase in the number of counterfeits in certain European countries. According to estimates, counterfeits account for more than one third of the total consumption, partly because organized crime groups operating in this field have shifted to the production of counterfeits within the EU borders during the COVID-19 pandemic. In addition to this, the number of adults who smoke illicit cigarettes (especially counterfeited ones) is growing, primarily for financial reasons.

Our region is especially burdened by smuggling and illicit trade and production of tobacco and its products.

Large differences in the prices of tobacco products in the region and the EU are particularly important for the illegal market.

There are two types of the illegal market in the countries of the region: transnational (which is well organized), and local (where cut tobacco and whole leaf tobacco are sold).

Due to the wide social acceptance of illicit tobacco and tobacco products as well as their profitability, this market attracts numerous criminal groups of varying levels of organization.

Situation in Serbia

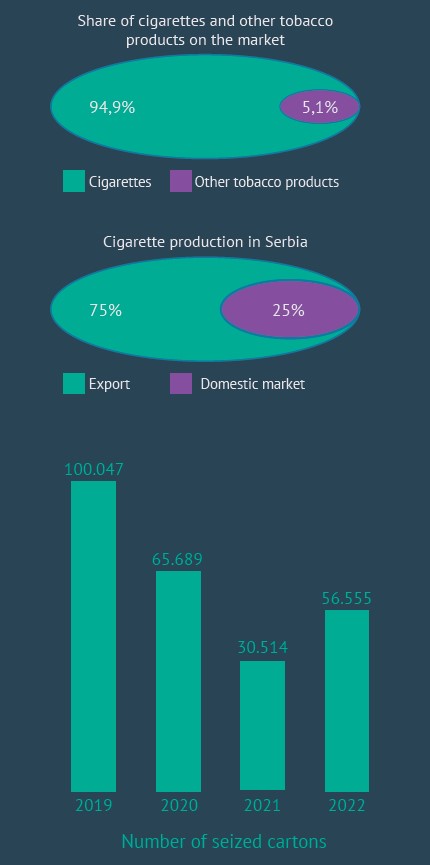

In the period between 2019 and 2022, cigarette production was on the rise. In 2022, it increased by about 7% against 2021.

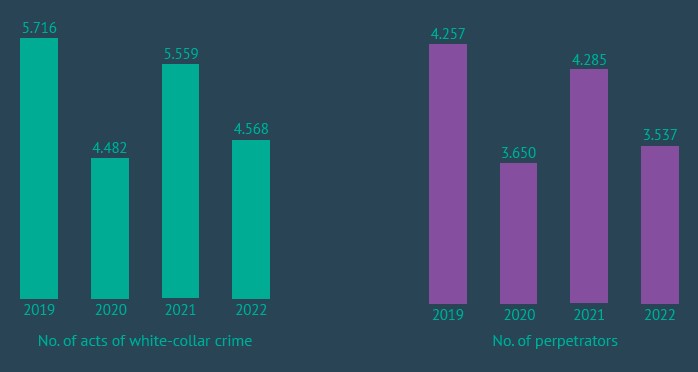

Cigarettes intended for sale on the domestic market account for 25% of the production, while cigarettes intended for export account for 75%. The legal market consists of 12.2 billion cigarettes (domestic and imported). The market share of cigars, cigarillos (0.2%), heat-not-burn tobacco and chewing tobacco (1.4%), cut tobacco and pipe tobacco (3.5%) is insignificant compared to the share of cigarettes (94.9%).

Smokers account for 43% of all Serbian citizens older than 18,

In 2022, the cigarette market recorded a slight sales increase (0.9%) against the previous year.

The cigarette sales levels are affected by: retail prices, purchase power, switch to other smoking products (cut tobacco for smoking, electronic cigarettes or new tobacco products, such as heat-not-burn tobacco), as well as the implementation of the Law on Preventing Population from Exposure to Tobacco Smoke and other regulations in the field of tobacco control.

Smuggling, illicit production and trade in tobacco products are spurred by the: high price of cigarettes and tobacco on the legal market, consumption and demand, quality of cigarettes, difference in retail prices in the country, neighboring countries and the EU, difference in economic policy measures (tax, customs and excise policy) on the tobacco and tobacco product markets in the country, in neighboring countries and the EU, etc.

According to estimates, the total illicit cigarette and tobacco product market in the Republic of Serbia accounts for about 21% of the overall market.

The illicit fine-cut tobacco market is still dominant and accounts for about 16% of the total market.

Illicit trade in cigarettes from Asian countries, mainly from the so called ‘white cheap’ category, passed through Serbia until mid-2021.

Cigarettes were transported by ships to the Montenegrin port of Bar, and then by land through Montenegro and Serbia (mostly through AP K&M) to EU member states, where they were sold.

The smuggling of such cigarettes made in the United Arab Emirates was particularly frequent, and according to Europol data, they accounted for 20% of the EU black market.

However, in mid-2021, the Montenegrin government prohibited the entry and sale of cigarettes in the duty free zone in the port of Bar, and in May 2022, decided to seize 1,500 stored containers of cigarettes.

This stopped smuggling operations through this zone and reduced illicit cigarette trade in Serbia and rest of the Western Balkans. It also contributed to the growth of the legal market, that is, to the evident reduction of ‘cheap whites’ on the tobacco black market in Montenegro, Bosnia and Herzegovina and Serbia.

The cessation of smuggling operations through the port of Bar created space for new smuggling channels. Cigarettes now arrive to the Serbian black market primarily from AP K&M, either bearing “Kosovo” excise stamps or without excise stamps, while smaller quantities arrive from North Macedonia, where they are much cheaper than in Serbia. These are smaller quantities intended for the domestic illicit market, with prices about 30% lower than regular. Some cigarettes are transported from the territory of AP K&M to Western European countries. As for other tobacco products, an increase has been observed in illicit trade and smuggling of ‘snus’ (teabag-like sachets filled with moist tobacco which are dissolved in the mouth) and hookah (waterpipe) tobacco and flavorings, which are smuggled from the EU to Serbia.

Cigarettes are smuggled into Serbia in different ways, frequently through smuggling channels outside border crossings and through alternative travel routes. They are transported in trucks and tank trucks, passenger vehicles with specially built hidden compartments, as well as vehicles for the transport of passengers in international traffic. These are usually all-terrain vehicles, light trucks and large vans, with special engine and chassis reinforcements, adapted to off-road conditions. The capacity of these vehicles is around 50 packs of cigarettes, while passenger vehicles with a maximum capacity of 25 to 30 packs are used on main roads. Different communication channels are used, such as radio stations, the internet, etc. Each transport is secured by a vehicle that leads the way and has the task of spotting police patrols and avoiding them.

In 2020, an interesting example was recorded where cigarette smuggling was used for diverting attention from drug smuggling. Namely, on the Horgoš border crossing towards the Republic of Hungary, a package of smuggled cigarettes was found in a secret compartment of a vehicle, behind which was another hidden compartment with four kilograms of heroin.

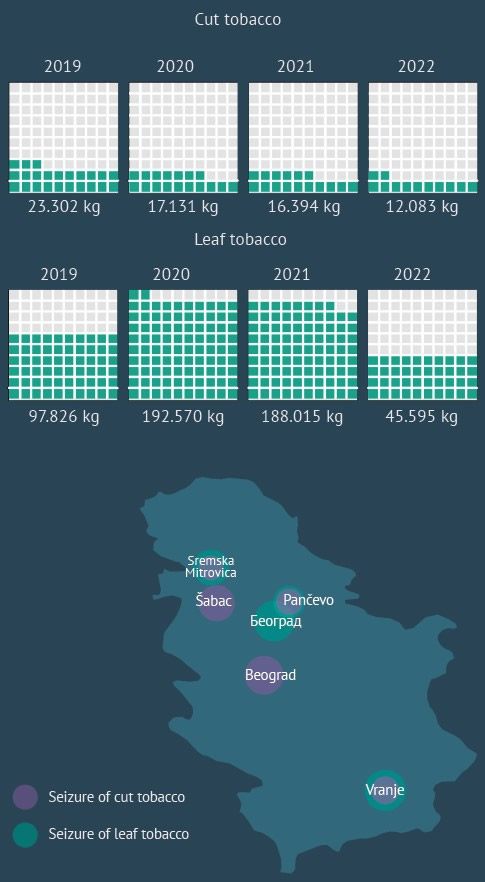

In 2019, a five-member organized crime group that purchased dried whole leaf tobacco in Serbia and sold it in batches of 300 kg each was detected. They sold more than twenty tons of cut tobacco. In 2021, another organized crime group was found. They participated in the acquiring, processing and sale of cut tobacco in Serbia, whereby they caused damage to the Serbian budget of about 69 million dinars. Five tons of cut tobacco were seized from them.

At border crossings, most cigarettes were seized during customs clearance on the way into the country and during inland controls. Goods usually had no accompanying documents, no excise stamps, i.e., information about the cigarettes, or they had the excise stamps of other countries. The majority of cigarettes were of the following brands: Blue Super Slims, Marble, Red Super Slims, Elegance Queen Light. President Gold Red, Merilyn, Ashima, Regina, etc. Special attention was paid to constant strengthening of border crossing controls using modern and precise diagnostics and detection systems for smuggled goods. The emphasis is on inland customs controls throughout Serbia, control of transit goods, small-scale smuggling and quality control of tobacco products. Quality control is what helps to detect counterfeit tobacco products, which do not meet numerous production and trade standards (this also applies to cut and other types of looseleaf tobacco) and which ruin consumers’ health and violate producers’ rights.

Although one can observe that the tobacco product market is stabilizing, the fact that it is a “live” and easily changing market requires a comprehensive and consistent strategy. An intensive and continuous international exchange of experience in preventing the smuggling of tobacco products is needed, especially with neighboring countries, because without this, the routes and extent of smuggling cannot be precisely determined. Police-to-police information exchange in the region is also important when it comes to planned routes, modes of transport and freight forwarders who transport tobacco and tobacco products, regardless of whether this takes place within the country or if they just pass through it. International cooperation is also important for the detection of shell companies and monitoring of transactions with offshore companies.

The Republic of Serbia has effective international cooperation in this field, which includes participation in international operations.

Tobacco and Cut Tobacco

In Serbia, tobacco is grown on an area of more than 3,800 hectares, where between seven and eight thousand tons of dried tobacco ca be produced annually. About 700 individuals (farmers) grow tobacco on registered farms. Until 2022, eight legal entities (production organizers, i.e. buyers and processors of tobacco) were registered and 670 individuals (producers) had cooperation agreements on tobacco production with them. The number of individual tobacco producers has been decreasing since 2020, which is, inter alia, a consequence of a drop in tobacco growing . Tobacco produced in Serbia is mostly intended for export, and only a small amount is used for domestic production of cigarettes and other tobacco products.

Illicit trade in cut tobacco mostly takes place in Serbia, as a result of surplus production or fictitiously presented underproduction by tobacco producers. These differences in quantities are not delivered to buyers, but are sold on the black market.

Although no major changes have been observed in general, there are some new trends in certain aspects of transportation and illicit sale of cut tobacco. Lately, it has been mainly distributed by courier services, where senders leave false personal data, making it difficult to detect the crime. The contact between those who cut tobacco and the buyers is established online. During transport, radio communication is used, while the use of cell phones is kept to minimum, which largely impedes locating.

As a result of a series of operational measures and activities, the number of illegal tobacco farms has significantly reduced. Among other things, the remote detection of illegal tobacco farms (through spectral analysis of satellite images of production areas, conducted for eight consecutive years) helped to identify illegal farms, where more than 800 tons of illicit tobacco was destroyed (the value of excise duty and VAT for this quantity of cigarettes would be EUR 89 million). At the same time, the areas where tobacco was planted illegally were reduced by 99% compared to 2016 (1,500 hectares were identified in 2016, and only 13 in 2022), which prevented the annual damage to the state budget in the amount of EUR 165 million (the amount of duties for this amount of cigarettes).

The tobacco and tobacco product market is constantly changing, keeping up with the development of alternative products that do not contain tobacco, but do contain nicotine or nicotine-free aromas intended for consumption. Serbia is working on amendments to the legal regulations that would make all such products equal to tobacco products.

In the category of fine-cut tobacco, make your own cigarettes (MYO) have registered a growth in production. MYO cigarettes are made when cut tobacco is inserted into empty filter tubes. Small machines have appeared on the market capable of filling several thousand cigarettes per hour, as did cigarette packing machines. Estimates say that there will be more and more such illicit products, in view of their low price and greater earning potential.

In the past few years, a trend has been observed in the EU of opening illegal plants for the industrial production of cigarettes. In Serbia, due to a significantly lower price of cigarettes, the opening of such plants is not expected, but one cannot rule out that they might appear in neighboring countries.

Oil and Oil Derivatives

In Serbia, between 2019 and 2022 (excluding 2020), the consumption of motor fuel was on the rise. This mostly resulted from the natural growth of consumption and partly from the reduction of the illicit trade in oil derivatives. Under the influence of the regional and global energy crisis caused by the conflict in Ukraine, in early 2022 changes occurred in the flows of oil and oil derivatives. Consumption was additionally increased in comparison with the previous year due to the increase in transportation and transportation costs, as well as due to the increase in supplies (for the purpose of ensuring a steady supply despite increased uncertainty). In addition to this, the importation of Eurodiesel was difficult, while its exportation was prohibited. The domestic oil refinery in Pančevo processed record-breaking 4.4 million tons of crude oil and semi-finished products, so that the share of locally produced derivatives in the total consumption increased significantly.

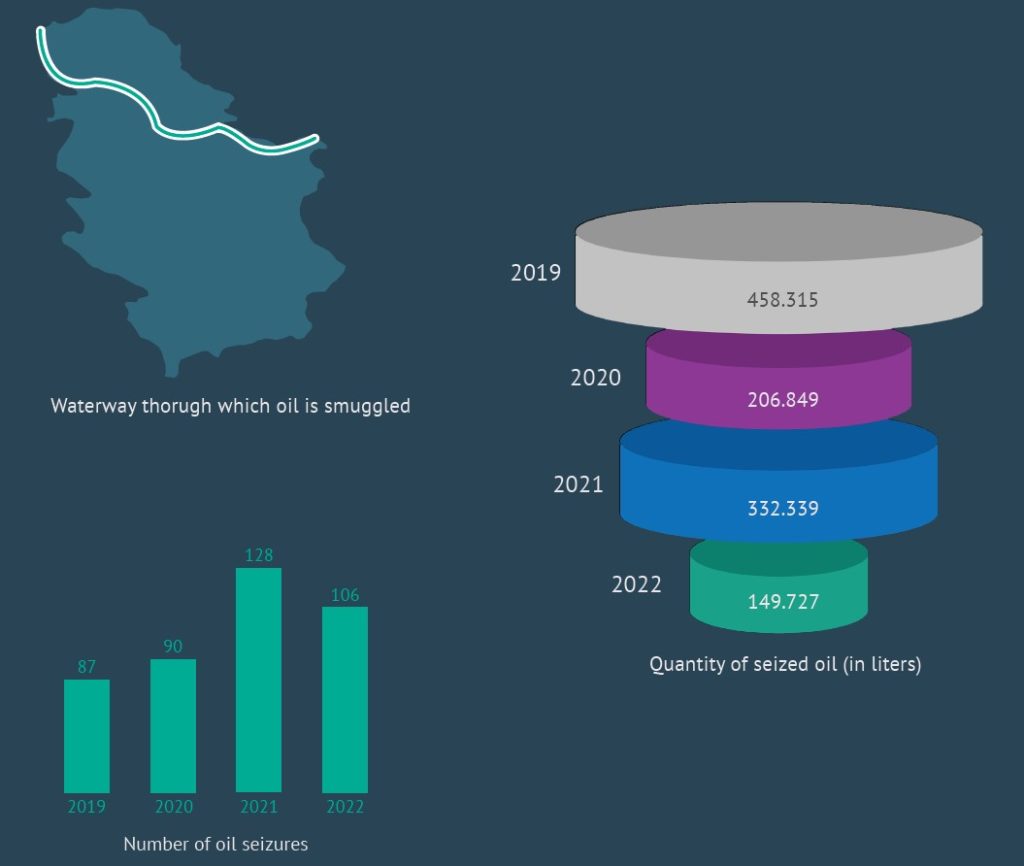

In Serbia, oil and oil derivatives are mostly smuggled by international vessels navigating the Danube. The smugglers are small, well-equipped and organized groups, which have vessels with large deadweight tonnage, which very frequently have built-in tanks for liquid cargo and powerful motor pumps with strong outboard motors. In addition to boats with strong motors and double hulls, they also use the so-called tanker vessels for storage, and usually steal oil derivatives from barges and ships or in agreement with foreign ship captains or crew members buy them at prices that are significantly lower than market prices. They are then transported to the river bank, and then, pumped out into plastic bottles and transported to warehouses or buyers. They also pour them into barrels or specially made tanks, i.e. welded boats called cubes, which are then submerged slightly below the surface of the water at selected parts of the navigable section of the Danube. They have high-quality means of communication (with each other and with foreign ships), as well as a large number of means of transport (trucks, tractors, tanks) for the distribution of goods from the river bank to customers. They are active only late in the evening and early in the morning, and they are also equipped with night-vision devices. During their operations, they observe a wider area and, if they realize they have been discovered, they very quickly flee from the place of commission. Owing to their high mobility, the perpetrators usually commit this criminal activity outside their place of residence.

One of the methods of illicit trade in oil derivatives is fraudulent declaration – the derivatives are imported under a tariff number of a product that is not chargeable with excise duty, and then sold as fuel on which excise was charged. In addition to this, in 2019 and 2022, there were many cases in which goods were stolen from rail tankers during transportation to the warehouse. In the past four years, more than 77 tons of oil and oil derivatives were stolen in this way. Cases of theft and resale of unmarked fuel by road have also been recorded. Namely, the NIS joint stock company sells abroad a certain quantity of unmarked derivatives that are exempt from excise duty and taxes, which is why it is subject to misuse. These derivatives are unloaded to illegal warehouses in Serbia, where they are mixed with certain agents, but in a way that does not affect their quality and values from the accompanying documents (weight, quantity, etc.).

Due to a difference in prices, fuel from Bosnia and Herzegovina is also smuggled into Serbia. These are smaller quantities which are used for reselling and supplying individuals and legal entities. They are mainly brought into the country in the fuel tanks of modified vehicles which cross the state border frequently (at least once a day). The fuel is unloaded 50 km from the border at most, because it would be unprofitable beyond this point due to a small difference between the purchase and sales price on the illegal market.

Expected Future developments

► If the prices of cigarettes increase, the Serbian market will become attractive for the sale of smuggled cigarettes. Until then, Serbia will remain a transit country.

► According to estimates, there will be an increase in the smuggling of fine-cut smoking tobacco produced in North Macedonia and Albania, which is packed in bags or packets bearing the markings of world-famous brands.

► The growth of prices of oil and oil derivatives will result in an increase of smuggling, and the prices will depend on the current geopolitical situation and new war developments.

Money laundering

Global and Regional Nature of the Issue

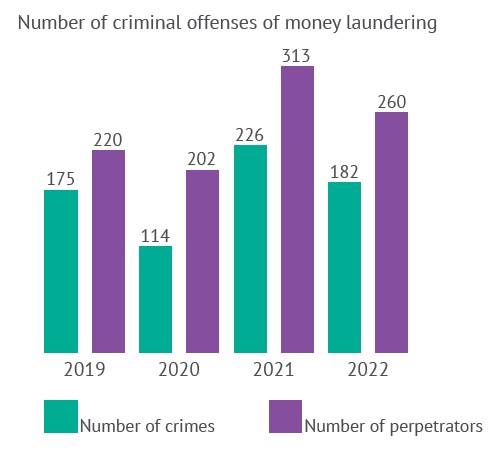

Money laundering is a global phenomenon and represents one of the most widespread criminal activities in the world. This is a very perfidious activity, which involves different types of organized crime and numerous sectors of the economy, and its frequency and complexity is increasing every year. In a long-term research (2016-2021), Eurojust determined that the number of registered money laundering cases increases by 12% to 14% per year, while the United Nations Office on Drugs and Crime (UNODC) has reported that laundered money accounts for 2-5% of the annual global GDP.

Situation in Serbia

Serbia is intensively developing an anti-money laundering system and undertaking comprehensive measures and activities aimed at protecting its economic and financial systems from the influx of money and assets suspected to have been acquired through criminal activities. Money laundering has become increasingly prominent as a result of an expansion of IT and e-business, as well as the constant creation of new opportunities in that area. One can say that the constant improvement of the business environment that goes hand in hand with technological progress in all spheres of the society, represents one of the principal factors which are favorable for money laundering. To this, one should add the dynamics, adaptability, sophistication and innovative character of money laundering techniques, which is why special attention is paid to the recognition and identification of new methods and timely institutional reaction. Another characteristic of money laundering is the constant danger from terrorist financing with dirty money, as well as the fact that the concealment of the origin of this money with the intention of turning it into legitimate money on the market represents an integral part of organized crime.

The National Money Laundering Risk Assessment identified the following predicate criminal offenses as those that carry the greatest risk of money laundering: tax evasion, unlawful production and circulation of narcotics, abuse of office and crimes of corruption. As for the vulnerability of sectors, banks are identified as the most vulnerable, i.e., those that carry the greatest risk in the financial sector, while in the non-financial sector, the greatest risk lies in real estate trade. Out of the representatives of both sectors which are required to comply with anti-money laundering regulations, banks, payment institutions and notaries file the largest number of reports suspecting money laundering to the Administration for the Prevention of Money Laundering at the Ministry of Finance. In 2022, these institutions filed 87% out of a total of 1,563 such reports, while in 2021, their reports accounted for 93% of a total of 2,053.

Money Laundering by Organized Crime

Money laundering techniques differ depending on the sector in which they are applied. As for OCGs that launder money, there are two basic types:

• OCGs that deal with money laundering professionally – “professional launderers”;

• OCGs for which money laundering is a side activity that completes their respective criminal activities.

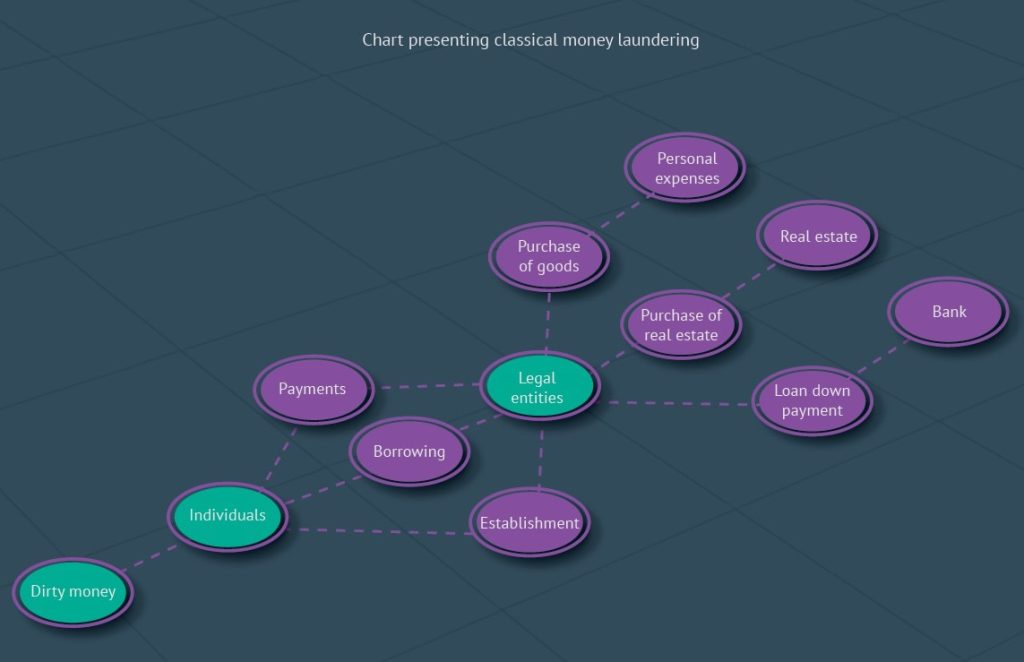

The ways in which OCGs made up of professional launderers provide their services are not relevant for users, who are interested only in the result and that is laundered money that cannot be linked to its illegal origin. Professional launderers do this for interested parties – owners and CEOs of companies operating in Serbia, officials at state authorities and public enterprises, persons abroad who want to extract money from their companies, as well as criminal groups. In the majority of such cases, the predicate crime is a tax crime, and the launderers’ task is to simulate business operations in order to extract dirty money from the account and return it to the user in the form of laundered cash.

Organized crime groups usually operate according to established schemes, taking advantage of individuals and legal entities, simulating trade in goods and services and simulating international payment operations. The goal is to make it appear that they have legitimate business relations using numerous transactions and simulation of business relations. Through a large number of cash flows, layering and commingling with legitimate money, the tracking of money becomes difficult, and the dirty money is thus separated from its source, which makes its control and detection impossible. Payment gateways are increasingly misused for this purposes. A person who wants to transfer funds to somebody, but to conceal the connection between the two, sends the money from his account to a payment gateway. The funds are then transferred from the gateway to the recipient’s account. Once the funds are transferred to the payment gateway, it becomes very difficult to determine their origin and the identity of the ordering customer.

An organized crime group made up of professional launderers is created when the leader rallies the members, identifies the MO and decides on their activities. OCG members are frequently accountants, who devise the entire scheme of concealment of the origin of funds and their placement into legal flows (several legal entities are established to ensure the flow of illegally acquired money, and accountants are authorized to dispose of funds in their accounts), charging a commission of 3-8% of the total amount of transfers for their services. The main motive for this type of money laundering is to enable the owners of legitimate companies to extract assets from their companies illegally, avoiding tax liabilities.

An important feature of the operation of these OCGs is that they constantly change legal entities through which they operate. They frequently introduce new ones, while “worn out” legal entities are dissolved to avoid taxes and other liabilities. After a while, once the cycle of irregular business activities is over, the founders (i.e., owners) sell their company stocks to persons who are inaccessible or who have no intention of engaging in business activity but do this for a fee. This makes it difficult for tax authorities to detect irregularities in business operations. Such companies do not file tax returns, do not maintain records on the trade in goods and services and avoid the assessment and payment of tax liabilities The new owners are neither responsible for the actions of the previous owner nor do they have business documents from the previous period, which makes it impossible to determine the relevant facts.

Organized crime groups which engage in money laundering as a side activity use the services of professional launderers for these purposes or launder the money themselves through loans to business entities under their control, investments in art works, investments in (purchase and construction of) real estate, cash loans, payment gateways and virtual money, organized betting, etc. Since money laundering is not their main activity, they use simpler methods of money placement and turn to professional launderers for its collection. Apparently distancing themselves from the dirty money, they are trying to make the connection with its source invisible through by investing. The predicate crimes of these groups (crimes that precede money laundering) do not belong to financial crime, but to the type of crime they otherwise deal with. These are usually general criminal offences, drug-related offenses and corruption offences.

Expected Future developments

► Future money laundering MOs will largely keep up with the progress of IT, which will increase the difficulty of detection and proving of this type of crime. This will call for a number of appropriate professional solutions, with a stress on the development of the system of prevention, timely amendment of legal regulations and stricter sentencing policy.

► The emergence of cryptocurrencies (virtual currencies) will quickly become a significant challenge with regard to threats from money laundering. Technological development makes it possible to develop countless cryptocurrencies, but their purpose, usefulness and justification cannot be clearly predicted at this moment. Practice shows that although cryptocurrencies are volatile, the amounts of money which are converted into them are a cause for concern. Complex challenges lie ahead when it comes to the imposition of control over the cryptocurrency sector, and this primarily refers to the definition and identification of those who perform activities and participate in trading, as well as to the monitoring and control of the flows of cash which is converted into cryptocurrencies and vice versa. The anonymity of the trading chain and ownership of virtual wallets, along with the undefined and unregulated nature of this area, creates extremely favorable conditions for money laundering as well as for other criminal activities performed by OCGs.

Tax Offenses

White-collar (financial) crime involves different financially-motivated illegal activities. This type of crime, which is complex according to its manifestations and difficulty of detection and proving, latently undermines the economic systems, processes and relations, creating numerous negative social, economic and financial consequences, and causing great distrust in state authorities among the population. Today, this danger is particularly stressed because of the pooling of capital and use of new electronic technologies for business communication, trade and transfer of funds.

Tax crimes directly undermine the fiscal interests of the state and pose a threat to the funding of public needs, which means that the implementation of measures for their suppression is one of the priorities in the fight against economic crime. The deprivation of the state treasury of revenues as a result of the commission of crimes through tax evasion or reduction of tax liabilities is the issue which is primarily dealt with by the Tax Police Sector of the Tax Administration of the Ministry of Finance, and partly also by the Ministry of Interior.

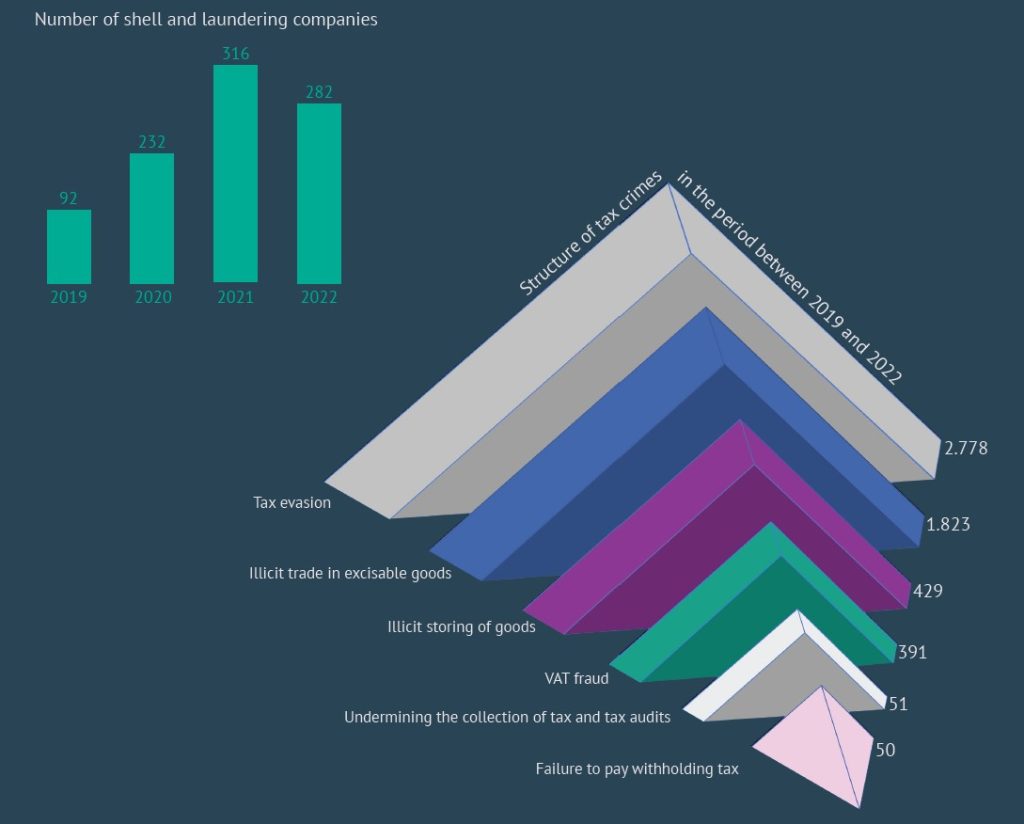

In the period between 2019 and 2022, a total of 4,968 criminal reports were filed against 6,594 persons for tax evasion in the amount of about RSD 55.5 billion and for criminal proceeds in the amount of more than RSD 14.5 billion. The most frequently committed criminal offenses were tax evasion, VAT fraud and illicit trade in excisable goods.

The budget of the Republic of Serbia is under the greatest risk from loss of revenues through the following types of tax: VAT, excise tax, corporate income tax and personal income tax.

More complex tax crimes, with an element of organization, where participants conspire to avoid the payment of tax and to acquire illegal proceeds, are committed in different ways. One of the specific MOs has been identified in tax fraud cases and refers to the importation of used motor vehicles from EU member states. Cars which dealership owners (individuals) have purchased abroad and paid in cash are delivered to Serbia accompanied by fake invoices issued by foreign suppliers, in which the vehicle prices are significantly lower than their real value. Fake invoices are issued by foreign business entities established by Serbian citizens who also have EU citizenship. These entities are really managed by Serbian OCG organizers, who use fictitious documents to make it appear that they have sold the cars in Serbia at much lower prices. Then, they calculate the purchase and sales prices of the car in such a way that a higher input VAT (calculated and paid at the time of importation on the increased base assessed in the customs procedure) is presented in the tax return, which is used for requesting and receiving a VAT refund. They do not record the real earnings from the sale of cars in Serbia (at realistic, much greater prices) in their ledgers and thus avoid the payment of tax and other levies.

There is still a significant number of so-called front and shell companies which entities that perform legitimate business activities use in order to avoid the payment of public revenues. Their early detection is of great importance in the fight against the grey economy. Data show that the number of detected front and shell companies increased by more than three times in 2022 compared to 2019.

In the period between 2019 and 2022, the cooperation with the Tax Police, the Ministry of Interior and the Security Information Agency (BIA) resulted in the detection of 21 criminal groups that had organized the issuance of fake invoices through their shell and front companies, thus enabling legitimate business entities to avoid the payment of tax liabilities. A total of 25 criminal reports were filed for tax evasion amounting to more than RSD 2 billion, where the illegal proceeds amounted to RSD 4.7 billion.

Practice has been observed of a large number of business entities, which, once they cease to perform business activities, do not engage in the liquidation procedure in accordance with the law, but, rather, re-register those entities to socially disadvantaged individuals, or to foreign nationals. New business entity owners and responsible persons do not take over the documents pertaining to previous business operation, which makes them impossible to audit.

The development of e-commerce has resulted in the expansion of the grey economy. E-commerce became dominant as a result of the global health crisis caused by the COVID-19 pandemic. Some individuals and legal entities advertise on internet portals and sell their goods illegally. Goods are delivered through courier services, payments are collected in cash, and their earnings are not recorded, which is how they avoid to calculate and pay the relevant public revenues. On the basis of investigations conducted so far, 33 criminal reports were filed for tax evasion in the total amount of RSD 940.8 million.

Expected Future developments

► The dominant tax evasion MO will remain through shell and front companies, simulation of business relations through the issuance of fictitious documents (invoices, bills of lading, etc.), which legitimate business entities use to avoid the payment of VAT, as well as the profit and income taxes.

► A special risk is posed by criminal groups that establish a large number of business entities not for the purpose of doing business, but in order to get unjustified VAT refunds. Business entities are frequently registered into the names of foreign nationals who are out of reach and cannot be checked. Organizers use such entities for fake mutual invoicing, with the aim of avoiding the filing of VAT returns and leaving the possibility for some of the entities to claim unjustified refund.

► The new e-fiscalization system, which makes it possible to monitor the recording of trade and issue fiscal receipts in real time will largely contribute to the early detection of irregularities and deviations from regular business operation, which might conceal the intention to avoid the payment of tax liabilities.

Counterfeiting of Money

Practice points to different participants in the counterfeiting of money, from individuals who engage in this specific type of crime on their own, to criminal groups with different levels of organization.

The counterfeiting of money is characterized by the use of modern technologies, which make it possible to make increasingly good and convincing counterfeits. Although this requires certain expertise and skills, the large-scale accessibility of computer equipment and software has greatly facilitated this criminal activity even for perpetrators with limited knowledge.

In the past four years, three organized crime groups were detected in Serbia as well as three illegal printing houses which counterfeited euros, dinars and dollars and other currencies.

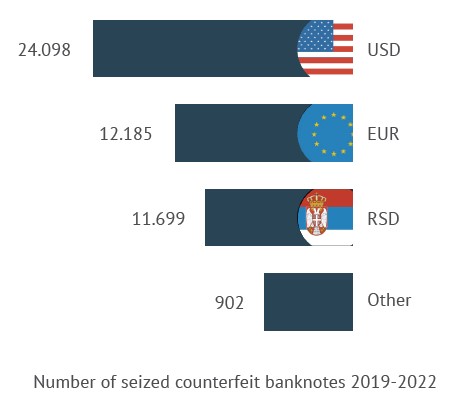

In the structure of detected counterfeit banknotes in the period between 2019 and 2022, US dollars had the largest share with 24,098 bills, out of which 23,923 were one-hundred-dollar bills. Moreover, 12,185 counterfeit euro banknotes were found and confiscated, and the largest number of them were in denominations of EUR 50, 100 and 10. In addition to this, 729 Croatian kuna (HRK) banknotes were seized, in the denomination of HRK 1,000. As for the local currency, 11,699 banknotes were seized, mostly in denominations of RSD 2,000, 1,000 and 500.

A four-member organized crime group from Belgrade was detected, which produced and put into circulation counterfeit USD 100 bills in Serbia during 2019 and 2020. A total of 20,564 such bills were found in their apartments.

When it comes to the distribution of counterfeit money, i.e., its acquisition for the purpose of putting it into circulation, what has been observed in addition to standard distribution, though to a lesser extent, is the offering through social media or darknet.

Experience shows that these offers are frequently fake and that their aim is fraud. This type of distribution of counterfeit money has not yet taken root in our country like it did in other countries.

The work is significant of the National Central Office for Counterfeit Money within the Criminal Police Directorate of the Ministry of Interior of the RS, which was established in January 2019 with the aim of centralizing all information on counterfeit money found and seized in Serbia.

The Office became the contact point for the exchange of complete information with the National Bank of Serbia, through which all expert examinations and analyses of confiscated counterfeit money are carried out. It therefore became a one-stop-shop for data on the number, quality and characteristics of seized counterfeit money as well as other details about it. Because of all this, the majority of seized counterfeit banknotes had been found and seized in Serbia before they were put into circulation. The Office created conditions for easier and better monitoring of trends in this area of crime.

Expected Future developments

► Within the domestic framework, this type of crime does not represent a major threat, because the euro and the dollar, as the currencies which, in addition to the dinar, are the most frequently counterfeited, are not the official legal tender. However, experience shows that this phenomenon merits special attention because of the danger from the appearance of organized counterfeiting of money (within organized crime groups and printing houses), as well as because of the use of modern technologies, which make counterfeits difficult to distinguish from the original banknotes and more difficult to detect.